Kudos to NZI (An Insurer Actually Worth Having) & ICIB Brokerweb (A Broker Also Worth Having)

If you’ve been around since the days when people actually used to watch television . . . like, the days when there were three channels, with seven minutes of programming punctuated by (what felt like) nearly as many minutes of commercials . . .

If you can remember those days, then chances are you’ll remember all the insurance commercials making essentially the yawningly same brand promise: 'If your world suddenly goes tits up, you can trust us to be there to help you pick up the pieces.'

Those were most viewers’ quintessential "Yeah, right" moments. I mean, who hasn’t got an insurance horror story or two? (On which note, here’s a. whole. slew. on my recent experience with AA Insurance, with one more wrap-up to be added shortly. Stay tuned for that.)

BUT . . . what if I told you that there’s an insurer that has genuinely “been there” for me, twice in the space of just one year?

In the first of those two instances, they really and truly hauled my ass out of the crap. (Watch for, at some time in the future, my belated commentary on the most despicable set of antics visited upon me last year by a very nasty FMG. Another story, for some time in the not-too-distant future; it happened before the advent of The Customer & The Constituent, but I’ll get around to exposing them for the stunt they pulled.)

Anyway, my saving grace, white-knight-to-the-rescue, genuinely-there-when-you-need-them insurer was NZI. (I bet you thought I was never going to get around to telling you.)

Remember This?

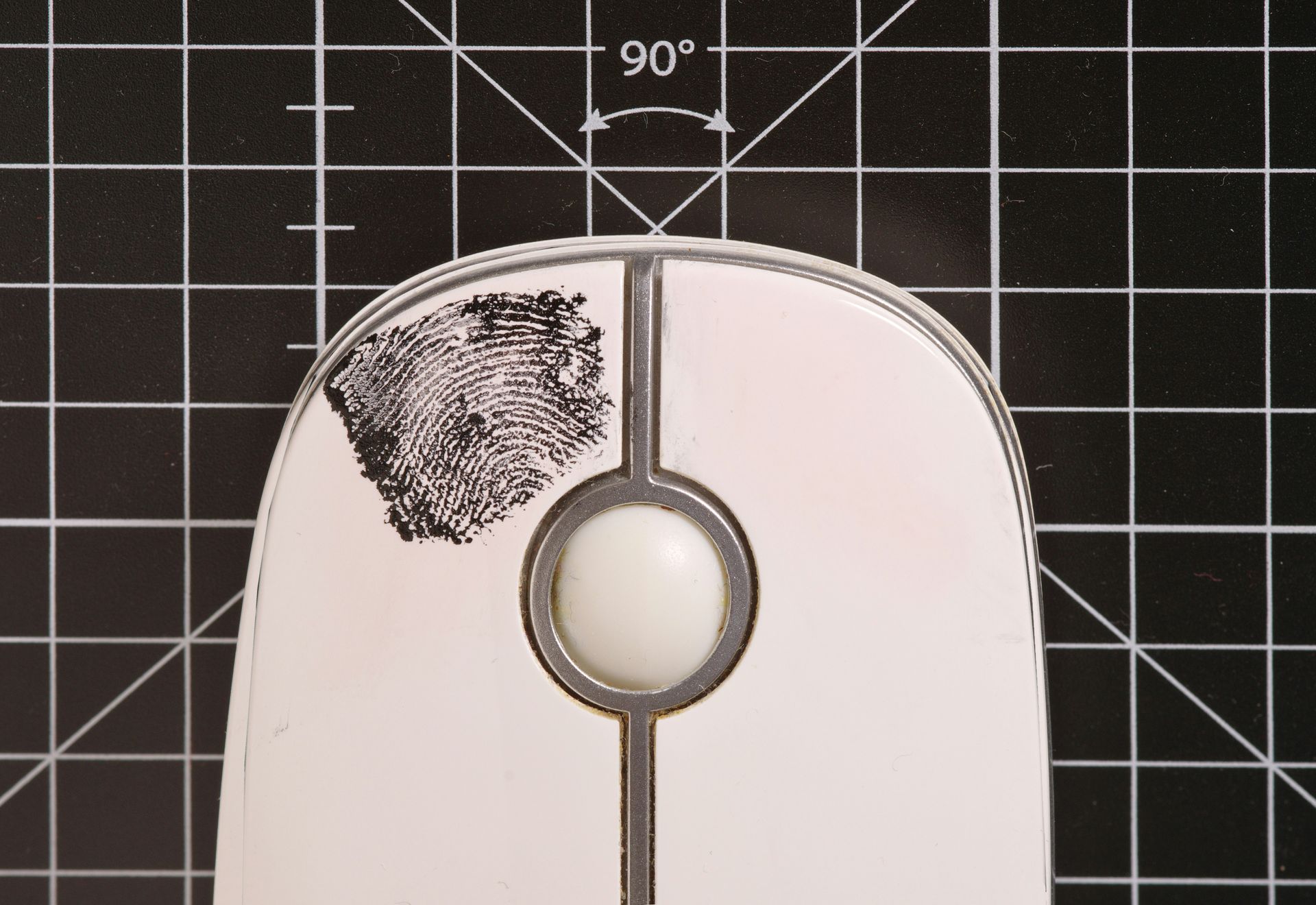

To focus, however, on my second and most recent genuinely-there-for-me experience with NZI, my regular readers will remember that my vehicle was broken into on the Petone foreshore last month. NOT a nice experience. One of the worst parts of it was the fact that my handbag and wallet (along with other less crucial items) were stolen . . . but also, heartbreakingly, so was the compact but expensive, and indispensable, camera (along with the precious seven years of contents of its memory card), which was in my handbag.

Narrowing the focus further to just the camera for the moment (in order to provide a specific demonstration of how NZI turned somersaults to accommodate my needs), this is the camera I use for many of the stories I write and upload here for you, my regular and valued readers. It so happened that I had lined up a special story for you, for which I needed to take photos, just a few days after the vehicle break-in and handbag/wallet/camera etc theft.

When I mentioned this to my extraordinary Claims Specialist at ICIB Brokerweb, she then on-mentioned it to the NZI Claims Handler, who swung into immediate and urgent action to obtain approval for a replacement camera . . . which wasn’t the exact same camera as stolen, as that had since gone out of production. I also wanted to buy this new camera not from their regular “big box” supplier, but from a specialist photography outlet (because I had VERY mistakenly thought this specialty camera retailer might help this tech-challenged sheila with a quick guided tour of the key knobs and buttons etc. Boy, was THAT a misguided assumption; check out THAT horror story, which I'll upload in the next few days).

In An Industry Where Big & Bureacratic Is the Norm, NZI Proved A Refreshingly Nimble Operation

Now, with NZI, as a bloody big organisation in its own right, it’s worth noting that it is, in turn, a subsidiary of an even bigger monolith i.e. IAG. The point being that, invariably, these big institutions take some considerable time to move things through their processes – especially if your situation is even slightly outside their norm. Almost as invariably, they’ve got the bureaucratic and often disjointed (and also often very uncaring and combative) internal culture that goes with that whole picture (take AA Insurance, by way of a particularly classic example . . . if you missed the links to my running commentary on that clownfest, pop back up to the third paragraph).

I, however, have experienced the polar opposite of those pain-in-the-ass insurer culture norms when it has come to NZI.

I’m told by the incredibly communications-proficient Claims Manager at my brokerage, ICIB Brokerweb, Michelle Botha, that the degree of effort NZI’s Claims Handler exerted to see the approval-for-replacement of all my stolen items within just 48 hours - in a process that was totally painless for, and deeply considerate of, me – exceeded even her normal impressive experience with this insurer.

The machinations that these two walking examples of exemplary customer service must have bulldozed their way through on my behalf were, of course, invisible to me, the policy holder. But I know they certainly pulled out some stops. Just so I could bring a particular story to you, my dear readers, at that time. (I’ll say thank you to them both on your behalf.)

Not Just One, but Two Debts of Deep Gratitude

And, as I mentioned earlier in this article, this second very positive experience with NZI (to whom I now owe two deep debts of gratitude) comes less than a year after their having come to the party in an even bigger manner, over an even bigger issue, that stood to have even bigger implications if they hadn’t. Watch out for that article sometime soon.

So . . . thanks a million, NZI and, very specifically, your Claims Handler who understands the value of a low-bureaucracy, high-customer service modus operandi. And thanks to the culture surrounding her that must have allowed her to assist me in this particularly rapid, streamlined and caring manner.

And, thanks yet again, to the highly competent and customer-focused ICIB Brokerweb, who have played an invaluable and indispensable role in my world this past year.